Securing a real estate golden visa is one of the most rewarding paths for investors looking to establish long-term roots in the UAE. With property as the anchor, this visa offers residency, stability, and solid ROI.

It’s also one of the few routes that lets you build wealth while gaining long-term security. For many, it’s not just about relocation, it’s about creating a future in a growing, global market.

Here’s a practical breakdown of what investors should know in 2026.

Property Investment Requirements

To be eligible for the real estate golden visa, your property investment must meet specific criteria. Whether you’re buying ready property or off-plan, these rules apply:

- Minimum investment of AED 2 million

- Title deed registered under your name

- Off-plan properties must be at least 50% paid

- Located in an area approved for foreign ownership

- If mortgaged, AED 2 million in equity must be proven

This is a clear-cut pathway for those wanting both a residency and an appreciating asset in a stable market.

Over 158,000 Golden Visas were issued in Dubai in 2023 alone. This shows just how popular the residency path has become, especially among property investors (source: Gulf News).

Valuation Rules: What Counts

Getting the numbers right matters. Your property must be valued at AED 2 million or more based on official valuation, not just your purchase agreement.

Incorrect or inflated valuations can delay or deny your visa, accuracy here is non-negotiable.

Approved Developers

Only work with developers pre-approved by local authorities. These ensure compliance and speed up visa processing.

Popular names include:

- Emaar

- Damac

- Nakheel

- Sobha

- Azizi

Each developer must be registered with the Dubai Land Department or relevant emirate authority. Buying from unapproved developers can make your investment ineligible.

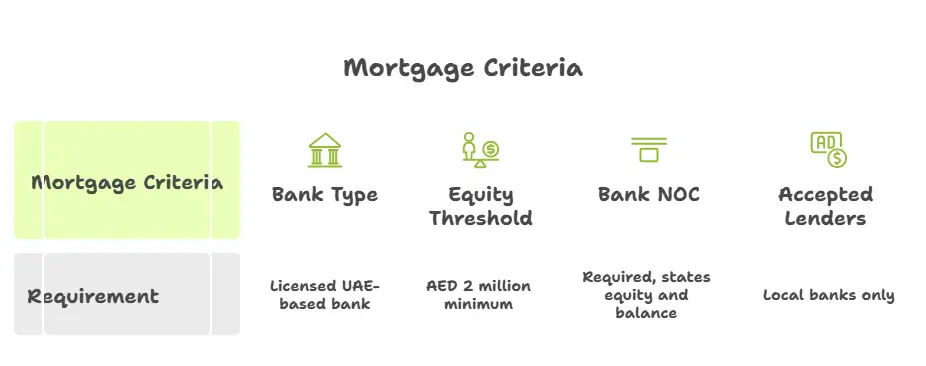

Mortgages and NOC Requirements

Yes, you can finance your investment, but there are strict guidelines to follow. Mortgaged properties are eligible only if your equity reaches the required threshold.

Here are the requirements:

| Mortgage Criteria | Requirement |

| Bank Type | Must be a licensed UAE-based bank |

| Equity Threshold | AED 2 million minimum (cash paid portion only) |

| Bank NOC | Required, must clearly state equity contribution and balance due |

| Accepted Lenders | Local banks only; international lenders not accepted |

Make sure your bank understands visa requirements to avoid documentation issues. Make sure your bank understands visa requirements to avoid documentation issues. If you’re considering Dubai as your base, our Dubai Golden Visa guide offers detailed steps, timelines, and requirements specific to that emirate.

Visa Renewals: Keep Your Status Active

The real estate golden visa is either valid for 5 or 10 years, depending on your investment profile. But renewals require ongoing eligibility.

To keep your visa active:

- Retain ownership of qualifying property

- Maintain required equity value

- Submit updated title deed and valuation report during renewal

- Ensure no legal disputes on the property

Missing any of these can risk cancellation at the time of renewal. Rental yields in Dubai hit around 6.8% in mid-2025. That’s higher than most major cities globally, and a big reason why real estate here continues to attract serious investors (source: Mieyar Real Estate Report).

How MyGoldenVisa.net Helps

Going through the process alone can be overwhelming. MyGoldenVisa.net offers dedicated support that covers everything from eligibility to approval.

| Our Services | What You Get |

| Property Eligibility Checks | We assess your chosen property before purchase |

| Bank Coordination & NOC Collection | Liaise with lenders to secure all required financial letters |

| Developer & DLD Verification | Ensure your developer and contract are visa-compliant |

| Complete Visa Filing & Tracking | Handle all GDRFA, ICA, and land department submissions |

| Post-Visa Support | Renewal alerts, family sponsorship, and compliance help |

With over 2,500 visas issued, a 5-star Google rating, and 20+ industry awards, we’ve built a track record of trusted, results-driven service for real estate golden visa applicants.

Wherever you are in the process, whether just starting or nearly ready, we’re here to make it easier, clearer, and a lot less stressful.

Common Mistakes to Avoid

Even serious investors can make small errors that delay or deny their golden visa.

Avoid these common pitfalls:

- Buying property under AED 2 million thinking it still qualifies

- Failing to get a proper valuation or skipping the bank NOC step

- Choosing a developer not registered with DLD or land department

- Assuming off-plan property qualifies without 50% payment

- Using unlicensed consultants or DIY application routes

Taking shortcuts in this process can cost time, money, or even your residency. Get it right from the start.

Quick FAQ: Real Estate Golden Visa

Q: Can I co-own a property and still qualify?

Yes, if your individual share is worth AED 2 million or more.

Q: Do I need to live in the UAE full-time?

No, but you should visit at least once every six months to keep your visa active.

Q: Can I include my family?

Yes, your spouse, children, and domestic staff can be included under your visa.

Q: What happens if property value drops later?

As long as you keep your ownership and meet renewal requirements, it won’t affect your current visa.

Still exploring your options? See our full UAE Golden Visa overview to compare all investor and non-investor pathways.

Final Thoughts

Real estate remains the most practical and secure route to long-term UAE residency. Beyond the visa itself, you gain a profitable asset, flexible living, and access to a tax-friendly environment.

Use this opportunity to build your future in one of the world’s most dynamic property markets, just make sure you follow the process step by step.

And if you need a partner? MyGoldenVisa.net is here to guide you the entire way.